In April 2023, Ghana’s Parliament passed the Income Tax (Amendment) Act, which brought significant changes to the Income Tax Act. These amendments encompass revised income tax rates for individuals, the introduction of a withholding tax rate on asset and liability realisation, and the addition of an extra income tax bracket. Moreover, the amendment introduced a minimum chargeable income, potentially linked to the earlier National Daily Minimum Wage increase announced by the National Tripartite Committee. These changes are expected to have a substantial impact on Ghana’s economy and its workforce.

Following the passage of the Income Tax (Amendment) Act, the Ghana Revenue Authority (GRA) revealed via a tweet on April 26th that the revised income tax rates and minimum chargeable income would become effective on May 1st, 2023. Consequently, starting from this specified date, individuals and businesses in Ghana must comply with the new tax regime. The implementation of the new tax rates, combined with the increased National Daily Minimum Wage, will likely affect the disposable income of workers and businesses in the country.

The change in the National Daily Minimum Wage, which took effect on January 1st, 2023, holds significant implications for businesses and individuals in Ghana. One such implication is that it sets the tax-free band for an employee’s taxable employment income, with any income earned up to the minimum wage amount being exempt from taxation. Consequently, whenever there is a change in the minimum wage, the Pay-As-You-Earn (PAYE) tax, which is the employee income tax, also undergoes adjustments. Employers and employees need to consider these changes when planning their finances for the year ahead.

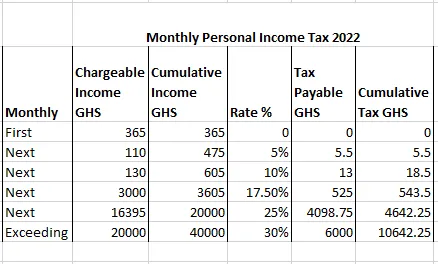

As illustrated in the table above, the previous tax-free band for taxable employment income was GHS 365. For instance, if an individual earned a gross basic income of GHS 1000, their net pay would amount to GHS 867 after deducting GHS 55 for social security contributions (employee) and GHS 78 for PAYE.

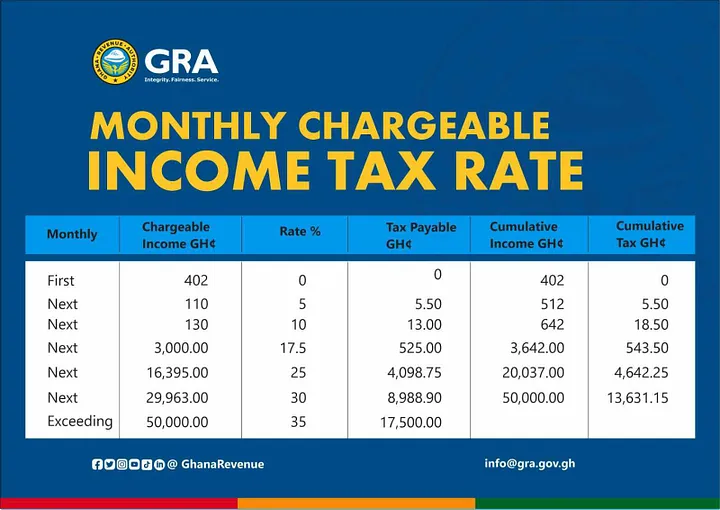

With the new rates, the tax-free band for the first taxable income now stands at GHS 402, aligning with the minimum wage amount. Using the GHS 1000 gross basic income example from before, the employee’s payroll figures under the new rates would be as follows:

– Gross Basic Income: GHS 1000

– SSNIT (Employee contribution): GHS 55

– PAYE: GHS 71.53

– Take-home pay: GHS 873.48

This represents a favourable change for employees, as their income tax (PAYE) decreases from GHS 78.00 to GHS 71.53, resulting in a higher take-home pay of GHS 873.48 instead of GHS 867.00. Clearly, the minimum wage adjustments have a direct impact on employees’ salaries.

To simplify the calculation of PAYE, we have provided a template for the current computation, which you can download by clicking on this link. Additionally, we have developed a mobile tax calculator app that allows you to calculate both the current PAYE and the new VAT in Ghana. This tool can be accessed and utilised for your convenience.