Personal Income Tax (PIT)

Personal Income Tax (PIT) is one of the tax types in Ghana. PIT is a direct tax which is calculated on the chargeable income of resident individuals and non-resident individuals to the extent to which that income has a source in Ghana. Resident individuals are taxed on their worldwide income.

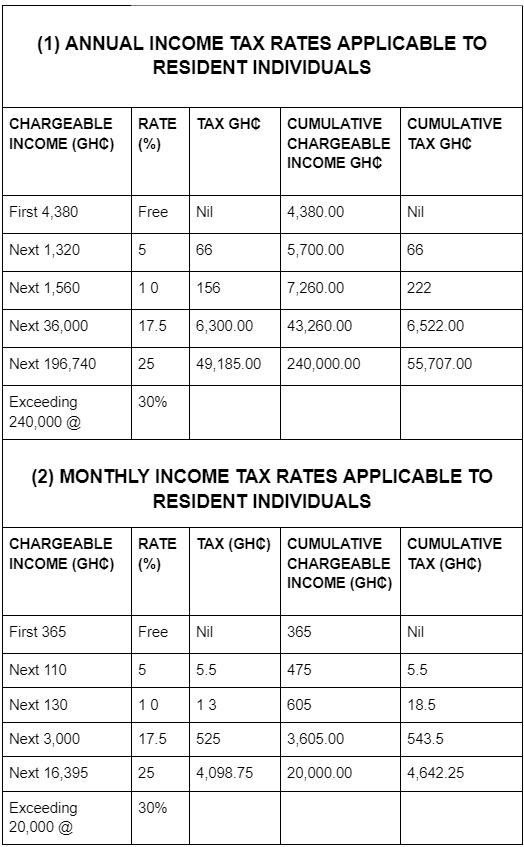

Generally, the chargeable income of a resident is taxed at graduated tax rates set out in the law.

With effect from January 1, 2022, the personal income tax bands for resident individuals were revised by the Income Tax (Amendment N0. 2) Act, 2021 (Act 1071) to align the tax-free income threshold with the national minimum wage of GH₵4,380 per annum (GH₵ 365 per month) set by the National Tripartite Committee (NTC).

The applicable graduated tax schedule for resident individuals is as follows:

*The rate applicable to income derived by non-resident individuals is 25%.

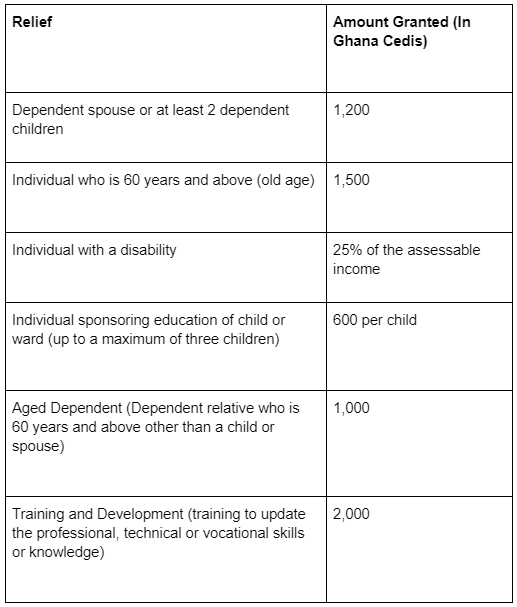

Personal Reliefs

Personal reliefs are available to resident individuals as provided for in the Income Tax Act. The current personal reliefs which can be deducted in arriving at the chargeable income of a resident individual are as follows:

Individuals may deduct mortgage interest incurred in respect of a residential property during the year in determining the individual’s chargeable income for the year.

Qualifying employees can also claim an upfront deduction of mortgage interest incurred in respect of a residential property on a monthly basis.

Kindly note that certain qualifying criteria must be met and some procedures must be followed in order to enjoy the personal reliefs.

For more information or technical assistance on tax, kindly contact Maker Hybrand or the author on:

Cell: +233 (0) 249 425 113

Tel: +233 (0) 302 972 249

E-mail: earthur@makerhybrand.com

info@makerhybrand.com